Short Term Loans Up To £5,000

Get online short-term loans from direct lender with 6 months to repay*

Applying won't affect your credit score.

How it works

Apply Online

Fill out our simple and secure online application form with your information and send to lenders. Don't worry it won't affect your credit score.

Lenders Review

After that, our lenders review your information and make their final decision about if they can work with you or not. Approx. 98.7% get loan approval.

Get Money

If your loan is approved and you are agree with your loan contract, your lender immediately deposit the funds directly into your bank account within 10-15 minutes.

Why choose us?

A smarter way for Britons to borrow

Same-Day Funding Available

If your loan is approved, you may get money in your account as early as 10 minutes*.

Loans that fit your financial needs

No matter what type of short-term financial needs you have, we offer loans ranging from £100 to £5,000.

Bad credit holding you back?

Having bad credit doesn't mean you are irresponsible with your finances. So, we look at more than just your previous credit score.

Find your perfect funding

LoanFinderPlus Blog

Do you have few spare minutes? If yes, great! Check out our blog that always bring good financial vibes only. We publish money saving tips, research, and new trends for our customers.

Visit our blog nowLet's do This

Applying won't affect your credit score.

FAQs Popular Questions

What is a short-term loan term?

Short-term loans are small, unsecured loans that must be repaid within weeks, months, or even years. To get these loans, you must be above 18 years old, be employed, earn a monthly income, and have a valid bank account.

Because these loans come with no collateral and credit requirements, short-term loans charge higher interest rates. Usually, Britons use short-term online loans to deal with unexpected financial emergencies.

How does short-term loan work?

At LoanFinderPlus, applying for short-term loans in the UK is 100% online, quick, and straightforward. You must submit your application with your employment, banking, and personal details.

After that, our responsible and direct lenders review it and offer you the loan terms, interest rates, and repayment schedule. If you agree and accept the offer, sign your loan contract and get money in your bank account within a few minutes.

What are the eligibility requirements to apply for an online short-term loan?

If you want to apply for a short-term online loan in the UK through LoanFinderPlus, the first step is to fill out our online loan application form. To be eligible for such loans, the borrower must meet the following:

- Be 18 years or older in age.

- Have an valid and active bank account.

- Must hold the citizenship or permanent resident of the United Kingdom.

- Have a regular income source from employment or via approved benefits.

- Mobile phone number, email, and address also required.

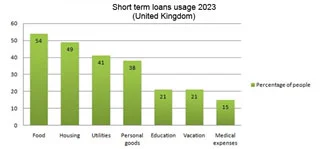

What are short term loans used for?

In the UK, Britons use short-term loans to support their financial aid until their next paycheck. uch loans are used, from utility bills to expensive car repairs. Also, some people in the UK apply for short-term loans from the direct lender to make their bad credit into good by paying it on time.

Some other reasons are:

- Home renovation or repair,

- Debt consolidation,

- To pay-off the medical debt,

- Paying for education expenses and much more.

What is the difference between short-term loans and payday loans?

Short-term and payday loans are best known for their fast approval and easy availability. The main difference between both is usually their repayment time. Payday loans offer the funds until the applicant's next payday, while short-term loans can range from weeks to months or even years.

Payday loans typically charge high-interest rates and are suitable only for financial emergencies. On the other hand, you probably get a lower interest rate with short-term loans if taken for a more extended period.

Can I get a short-term loan with bad credit?

Yes, short-term loans for bad credit people are possible. LoanFinderPlus offer online short-term loans for people with bad credit in the UK. Many lenders offer short-term and payday loans even if you have a bad credit score. However, you may need to pay high-interest rates and fees.

Can I get a short-term loan with no credit check?

No, getting a short-term loan with no credit checks is impossible. Even payday loans and other types of loans are only possible to get by doing complete credit checks. If you find a lender advertising no credit check loans, you should avoid them. They are breaking the rules set by the Financial Conduct Authority (FCA).

Applying won't affect your credit score